tax on venmo cash app

El IRS tiene nuevas reglas para cobrar taxes cuando se trata de aplicaciones como PayPal Zelle Cash App o Venmo. Venmo CashApp and other third-party apps to report payments of 600 or more to the IRS.

Hot Wheels Storage Hot Wheels Display Etsy In 2022 Hot Wheels Storage Hot Wheels Display Hot Wheels Display Case

While Venmo is required to send this form to qualifying users its worth.

. The changes to tax laws affecting cash apps were passed as part of the American Rescue Plan Act in. 1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service. This new tax rule might apply to you.

Theres a lot of chatter online about a new tax reporting requirement that applies to users of third-party payment processers like Venmo PayPal Zelle and Cash App. Here are the rules around third-party cash apps and the forms youll need for the 2021 tax year. By Jeanne Sahadi CNN.

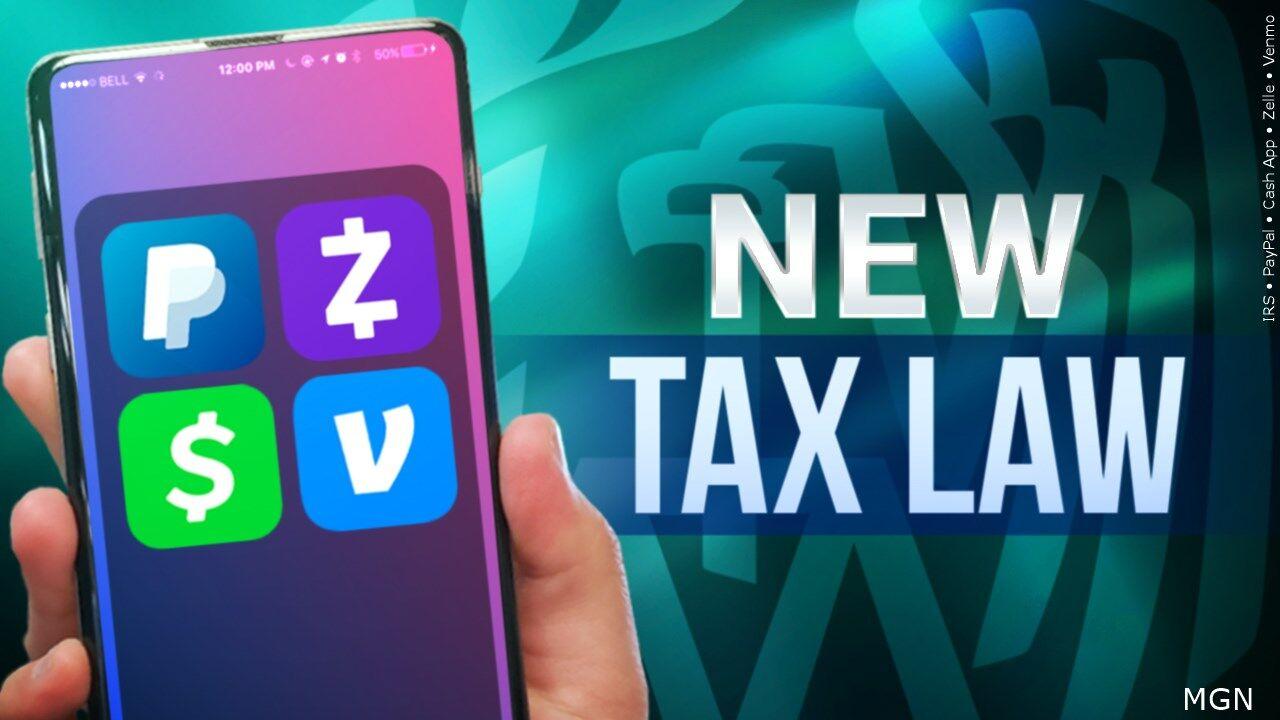

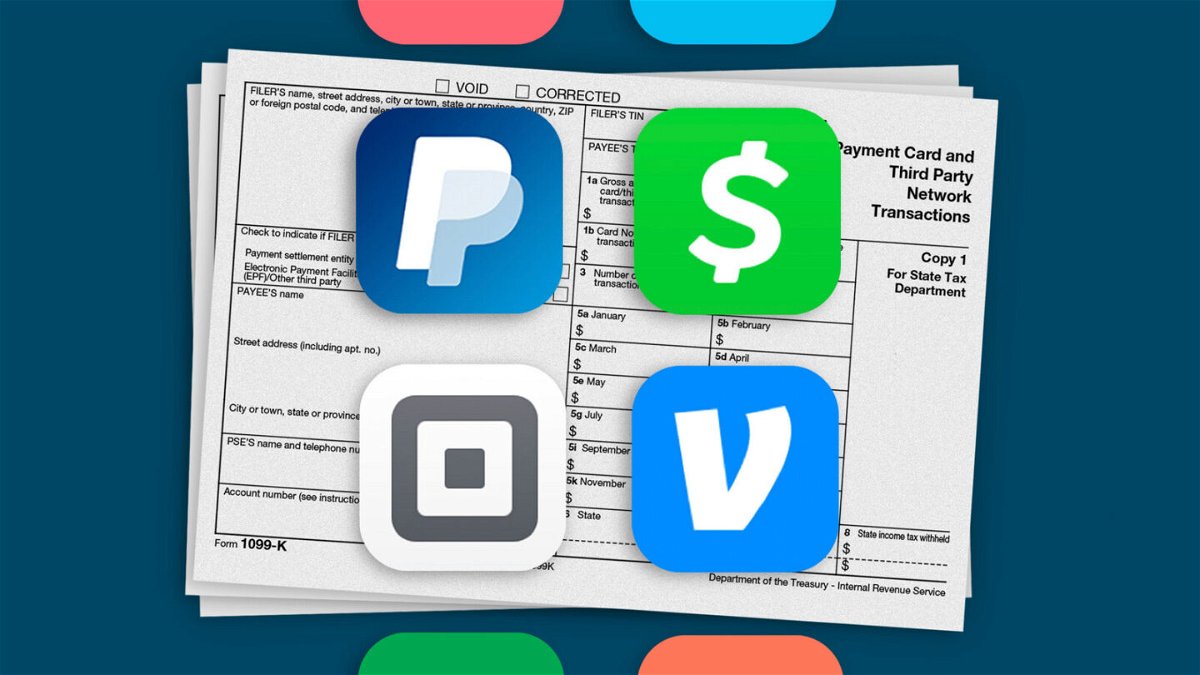

Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. Under the prior law the IRS required payment. Rather small business owners independent contractors and those with a.

People on social media are freaking out over claims that the Biden administration is setting new taxes on payment apps like PayPal Venmo. And for many people in 2023 life will bring a 1099-K form to ensure certain transactions on apps like PayPal Venmo and Cash App are taxed appropriately. Beside above how much tax does Cash app take.

Venmo at a Glance. A new tax law went into effect that requires third-party payment processors to report business transactions that meet certain new thresholds to the IRS. Heres who will have to pay taxes on.

1 2022 people who use cash apps like Venmo PayPal and Cash App are required to report income that totals more than 600 to the Internal Revenue Service. You wont have to automatically pay taxes on all the money you received through Venmo or the Cash App but this does increase the importance of putting in useful notes on transactions. This will change the way that you file your taxes next year.

Life doesnt always give you lemons sometimes it gives you a Lego to step on or a chocolate chip cookie thats brimming with raisins. Cash App Transactions That Are Not Taxed. Exit Full Screen.

Small businesses who used Venmo or other tax apps could now face taxes. Churches and ministries everywhere regularly use apps like Venmo Paypal and Cash App to easily receive charitable funds from their donors and members. Currently cash apps are required to send you 1099 forms for transactions on cash apps that exceed a total gross payment of 20000 or exceed 200 transactions total within a single calendar year.

613 PM CST February 17 2022. Starting this year the IRS is legally requiring all transactions totaling over 600 dollars on third party apps like CashApp and Venmo to be reported. Cash App for example tweeted on Feb.

Cash App Wont Have New Taxes in 2022 Despite Claims. Transactions that can be excluded from income include certain kinds of P2P payments as well as other types of payments such as. Video TopicVenmo Taxes 2022 - IRS Has Begun Imposing Tax on Venmo - 1099K FormDue to its ease of use and incredibly user-friendly interface Venmo has becom.

Money received from a friend as a gift. Beside this can I use cash App for my tax return. This is due to the new tax reporting requirement put on third.

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. Here are some details on what Venmo Cash App and other payment app users need to know. Anyone who receives at least 600 in payments for goods and services through Venmo or any other payment app can expect to receive a Form 1099-K.

Social media posts like this tweet that was published on September 15 have claimed that starting January 2022 if you receive more than 600 per year through third-party peer-to-peer payment apps like Cash App Venmo or Zelle you will be taxed on those transactions. Están vigentes desde el 1 de enero de 2022 y dicen que cualquier persona que reciba 600 por año usando Venmo PayPal Zelle o Cash App recibirá un formulario 1099-K para reportar esos ingresos en sus impuestos. Payments of 600 or more through third-party payment networks like Venmo Cash App or Zelle will now be reported to the IRS.

Cash App vs. January 19 2022. 4 that it will send 1099s just to users enrolled in its Cash App for Business program.

This new rule does not apply to payments received for personal expenses. Those posts refer to a provision in the American Rescue Plan Act which went. The IRS is cracking down on the apps to make sure everyone is paying their fair share of taxes.

Under the American Rescue Plan a provision went into effect at the beginning of this year that directs third-party payment processers to report transactions received for goods or services totaling over. Money received from a roommate to pay their portion of the bills. Squares Cash App includes a partially updated page for users with Cash App for Business accounts.

937 AM CST February 18 2022. Getting paid on Venmo or Cash App. Not all cash app transactions are taxed.

Starting in 2022 a new tax law went into. New Cash App Tax Reporting for Payments 600 or more. 2 fee per ATM transaction Cash App reimburses fees for up to three ATM withdrawals per 31-day period up to 7 per withdrawal for users with at least 300 in.

VERIFY previously reported on the change in September when social media users were criticizing the IRS and the Biden administration for. Yes you can use cash app for the. Standard transfers on the app to your bank account take two to three days and are free while instant transfers include a 15 fee.

As stated in the comments a user may only receive a 1099-K form if they receive more than 600 on a Cash for Business account starting in 2022. This is probably most important for large transactions like splitting a beach vacation rental or something similar. An FAQ from the IRS is available here.

When you make a payment using a credit card on Cash App Square adds a 3 fee to the transaction.

Does The Irs Want To Tax Your Venmo Not Exactly

Pantry Door Spice Rack Etsy Door Spice Rack Spice Rack White Wood Stain

Send Receive Payments Online Venmo Venmo Accounting How To Get Money

/images/2022/02/08/cash-app-and-venmo.jpg)

What Venmo And Cash App Users Need To Know About New Tax Rules Financebuzz

Hot Wheels Storage Hot Wheels Display Etsy Hot Wheels Storage Hot Wheels Display Hot Wheels Display Case

Can I Send Money From Paypal To Cash App Green Trust Cash App Fast Money Online Send Money How To Get Money

Hot Wheels Storage Hot Wheels Display Etsy Hot Wheels Display Case Hot Wheels Display Hot Wheels Storage

Pantry Door Spice Rack Etsy Door Spice Rack Spice Rack Door Mounted Spice Rack

Do You Use Cashapp Zelle Or Venmo Don T Make This Mistake In 2022 Make Easy Money Venmo Banking App

Pantry Door Spice Rack Etsy Door Spice Rack Spice Rack Essential Oil Rack

Tax Law Changes Could Affect Paypal Venmo And Cash App Users

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You News Wsiltv Com

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Pay Letilorenza On Cash App In 2022 Allianz Logo Cash

No Venmo Isn T Going To Tax You If You Receive More Than Us 600 Tech

Hot Wheels Storage Hot Wheels Display Etsy Hot Wheels Display Hot Wheels Storage Hot Wheels Display Case

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Kesq

3 Ways To Avoid Taxes On Cashapp Venmo Paypal Zelle Legally Youtube In 2022 Tax Rules Tax Venmo

New Tax Law Requires Cash Apps Report Transactions Of 600 To The Irs Venmo Paypal Zelle Apple Pay In 2022 Venmo App Irs